The Akemona tokenization platform embeds the rules for lifecycle events in a token while providing automation and tracking of documents and metrics to manage the lifecycle of smart securities.

Problem

Green and social bonds have their proceeds exclusively applied to finance green and social projects. Sustainability bonds have components of both green and social projects. The proceeds of sustainability-linked bonds are used for general purpose. However, the issuer commits to incorporate forward-looking sustainability outcomes by measuring key performance indicators. The allocation of the proceeds of these bonds to eligible projects must be monitored through the lifespan of bonds. The risks and benefits from such projects are tracked, recorded, verified and periodically reported to the issuer and investors.

These type of bonds require complex coordination between the issuer, investors and intermediaries. Allocations are monitored through a portfolio management system, a bond lifecycle management system, project tracking and governance systems across different organizations. These systems and their software are isolated, disconnected, inefficient, and costly to synchronize by exchanging emails and documents. As a result, such sustainability bonds have substantial administrative overhead, which slows down the exchange of information, raises the cost of capital for the issuer and reduces profitability for the investors.

Solution

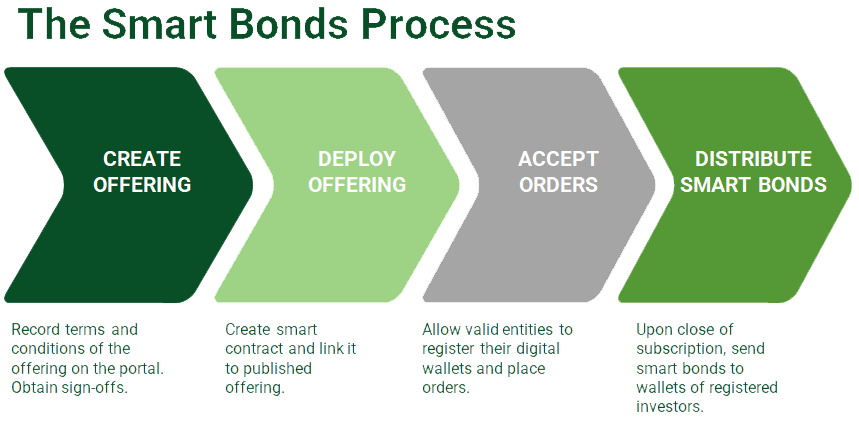

The Akemona platform combines blockchain-based smart bonds with a system for selection, tracking, and reporting of projects financed by such bonds.

Our systems have integrated smart contracts with a content management system. This allows the Akemona platform to create smart bonds and link smart bonds with the content for tracking projects, assessment and quantification of their benefits for reporting to the issuer and investors.

The centralization and linking of documents to smart contracts helps in synchronization of communication of environmental and social sustainability objectives of the projects among all deal participants.

As long as the bond is outstanding our system supports matching allocations of net proceeds to eligible projects.

The reporting system keeps up to date information on the use of proceeds and generates annual reports on the projects and their net impact.

The Akemona platform efficiently tokenizes and manages the lifecycle of:

Bonds

- General Purpose Bonds

- Eurobonds

- Global Bonds

- ESG Bonds

- Green Bonds

- Social Bonds

- Sustainability Bonds

- Sustainability-Linked Bonds

Equity Tokens

- Common Equity

- Preference Shares

- Equity Classes

Convertible Debt and Rights

- Convertible debt

- Offer permission to use certain scarce asset or resource.

Powered by smart contracts, distributed ledger technology and our content management system, the Akemona platform eliminates inefficient workflows and duplicative processes.