Financial institutions are looking for new ways to securitize debt, share risk and enhance efficiency. Bond lifecycle comprises a multitude of deal participant workstreams split into silos creating inefficient workflows in the fixed income value chain. Duplicative processes require costly reconciliation . Inefficient workflows and duplicative processes reduce profitability from fixed income investments.

Problem

While bond markets have proven to be stable, efficient and safe, they leave room for process improvement. The underlying processes in the bond markets are sub-optimal, insecure, and require continuous exchange of emails to keep all deal participants in sync during issuance, closing, settlement, registration of ownership, calculation and payment of interest, and redemption.

Solution

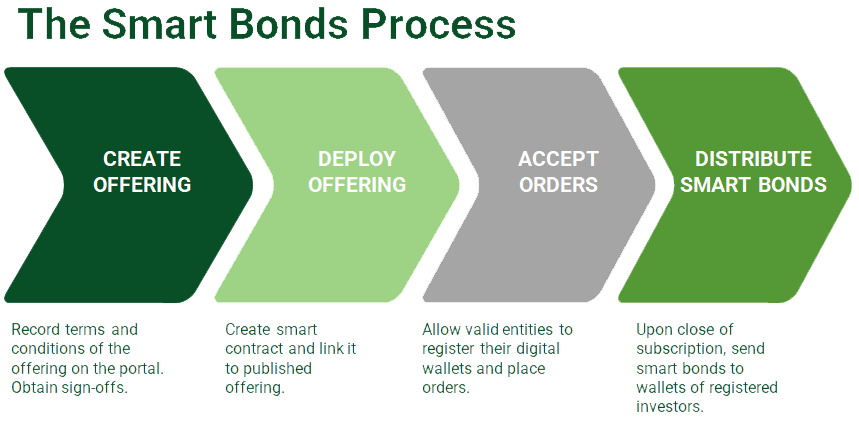

The smart bonds technology developed by Akemona is based on smart contracts and distributed ledger. Akemona creates smart bonds by converting terms and conditions in the offering documents to smart contracts. Akemona’s smart bonds automatically synchronize pricing, terms and conditions, ownership and trade information throughout the lifecycle of bonds. The smart contracts which create tokenized bonds are integrated with a content management system for referencing documents. This enables all deal participants to:

- share the same digitally signed information

- execute transactions across multiple time zones

- simultaneously transfer funds and deliver securities

As a result, settlement in primary and secondary markets is expedited, email traffic is reduced, and risk of discrepancy is eliminated making the process more efficient and secure.